Our Commitment to Your Security

Security & Fraud Note to Members

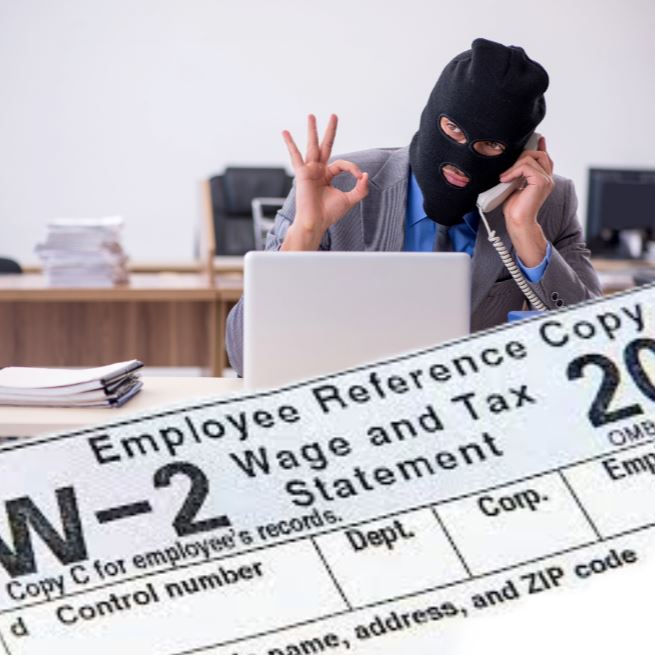

Tax Fraud/Scams Content:

Phishing Scams

Taxpayers and tax professionals should be alert to fake communications from those posing as legitimate organizations in the tax and financial community, including the IRS and the states. These messages arrive in the form of unsolicited text (smishing) or email (phishing) to lure unsuspecting victims to provide valuable personal and financial information that can lead to identity theft. The IRS initiates most contacts through regular mail and will never initiate contact with taxpayers by email, text, or social media regarding a bill or tax refund.

Third-party Accounts Help Fraud

Swindlers pose as a "helpful" third party and offer to help create a taxpayer's IRS Online Account at IRS.gov. In reality, no help is needed. The online account provides taxpayers with valuable tax information. But third parties making these offers will try to steal a taxpayer's personal information this way. Taxpayers can and should establish their own online accounts through IRS.gov.

Fake Charities

Bogus charities are a perennial problem that gets bigger whenever a crisis or natural disaster strikes. Scammers set up these fake organizations to take advantage of the public's generosity. They seek money and personal information, which can be used to exploit victims through identity theft further. Taxpayers who give money or goods to a charity might be able to claim a deduction on their federal tax return if they itemize deductions, but charitable donations only count if they go to a qualified tax-exempt organization recognized by the IRS.

Fraudulent Tax Preparers

Most tax preparers provide outstanding and professional service. However, people should be careful of shady tax professionals and watch for common warning signs, including charging a fee based on the size of the refund. A major red flag or bad sign is when the tax preparer is unwilling to sign the dotted line. Avoid these "ghost" preparers, who will prepare a tax return but refuse to sign or include their IRS Preparer Tax Identification Number (PTIN) as required by law. Taxpayers should never sign a blank or incomplete return.

Social Media Advice

Social media can circulate inaccurate or misleading tax information, and the IRS has recently seen several examples. These can involve common tax documents like Form W-2 or more obscure ones like Form 8944. While Form 8944 is real, it is intended for a very limited, specialized group. Both schemes encourage people to submit false, inaccurate information in hopes of getting a refund. Taxpayers should always remember that if something sounds too good to be true, it probably is.

Offer in Compromise Mills

Offers in Compromise are an important program to help people who can't pay to settle their federal tax debts. But "mills" can aggressively promote Offers in Compromise in misleading ways to people who clearly don't meet the qualifications, frequently costing taxpayers thousands of dollars. Taxpayers can check their eligibility for free using the IRS Offer in Compromise Pre-Qualifier tool.

Schemes Aimed at High-income Filers

Charitable Remainder Trusts are irrevocable trusts that let individuals donate assets to charity and draw annual income for life or a specific period. Unfortunately, these trusts are sometimes misused by promoters, advisors, and taxpayers to try to eliminate ordinary income and/or capital gain on the sale of the property.

iTHINK Financial Card Service Fraud Prevention Team

Our Card Services Fraud Prevention Team will never ask the member for their full card number, pin number, expiration date, CVV code off of the card, social security number, or Online Banking credentials. This information should never be shared with anyone.

The iTHINK Financial Card Services Fraud Prevention Team sends the text alerts using a short code, not an actual phone number. Our Card Services Fraud Prevention Team calls from the following phone number: 800-813-5244.

If a member receives a text or call inquiring about a transaction that they didn’t make, remind the member that they do not have to provide information to the caller/text. If they feel uncomfortable with the situation, it is always best to visit their local branch or call the credit union directly at 800-873-5100 and speak with an employee directly. Our call center staff is available to help them from 8 am – 9 pm ET.

Fraud Text Alerts

iTHINK Financial offers free and convenient real-time fraud alerts via text message. These alerts can help prevent fraudulent activity on your signature-based debit and credit transactions.

1. All cardholders with a valid mobile number on file are automatically enrolled! Ensure the phone number we have on file is correct by logging into Online Banking

2. We’ll send you a text message if there is suspicious activity detected on your account.

3. Reply to confirm whether you recognize the transaction.

• If you do not recognize the transaction, we will block the usage of your card.

• If you do recognize the transaction, your card will remain available for use.

Fraud text alerts will come from a short code, not an actual phone number.

iTHINK Financial also uses the phone number 800-813-5244.

Reminder: iTHINK Financial will never ask for your personal information via text. We will never ask for your username or password, full card number, expiration date, CVV code, or social security Number. If you are in doubt about the validity of a call or text, please call our main number at 800-573-5100 or visit our Contact Us page. Our call center staff is available to help them from 8 am – 9 pm ET.

iTHINK Financial is committed to preserving and protecting the privacy and security of your Nonpublic Personal Information (NPI). This commitment is a fundamental mission of your Credit Union. The Credit Union maintains strong security controls to ensure that your information is protected and consistently monitors and improves upon verification processes to protect against unauthorized access to personal information.

For more information about our Privacy Disclosure , please contact us at serviceplus@ithinkfi.org or 800.873.5100.